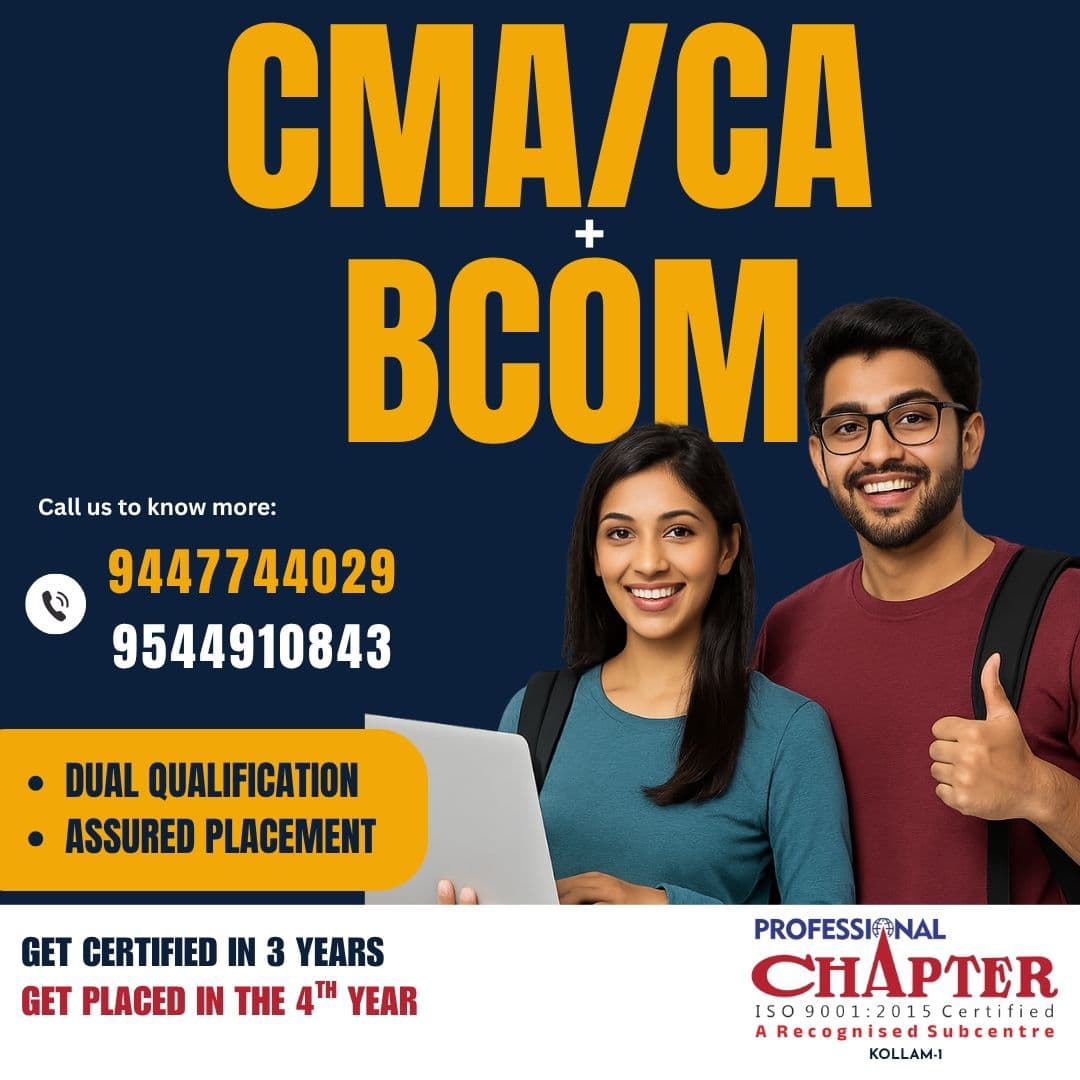

- Call: 9567402911, 954491084

- Email: professionalchapterkollam@gmail.com

Chapter College Professional Academy

Chapter College Professional Academy

The Cost and Management Accounting (CMA) course in India, administered by the Institute of Cost Accountants of India (ICAI), is a professional qualification focused on cost accounting, financial management, and strategic decision-making. The CMA course is ideal for students looking to build expertise in cost and management accounting, with applications in both industry and public practice.

Overview of the Indian CMA Course

The CMA course equips students with the skills required for effective cost control, budget preparation, resource allocation, and strategic financial planning. It is especially valuable for those aiming to work in areas like manufacturing, finance, or public enterprises, where cost efficiency and resource optimization are critical.

Structure of the CMA Course

The CMA program is divided into three levels:

1. Foundation Level

➢ Eligibility: Students can enroll after completing 10+2 or an equivalent exam.

➢ Focus: Covers basic concepts in economics, accounting, laws, and cost

accounting principles.

➢ Objective: Lays the groundwork for more advanced studies in cost and

management accounting.

2. Intermediate Level

➢ Eligibility: After clearing the Foundation level or holding a relevant

undergraduate degree.

➢ Focus: In-depth studies in cost accounting, direct and indirect tax, financial

management, and company law.

➢ Objective: Equips students with knowledge for practical application in cost

and management practices.

3. Final Level

➢ Eligibility: Upon clearing the Intermediate level.

➢ Focus: Advanced concepts like strategic cost management, financial

strategy, performance evaluation, and corporate laws.

➢ Objective: Prepares students for complex roles in financial and cost

management, strategic planning, and corporate governance.

Examination Pattern

Each level has a set of exams that test both theoretical knowledge and practical application. Exams are held twice a year (in June and December), covering subjects within each level’s syllabus. Students must pass all subjects in a level before moving to the next.

Practical Training Requirement

In addition to passing exams, CMA students must complete practical training,

which includes working under the guidance of a practicing CMA or in an approved organization. This hands-on training ensures that the students are prepared for real-world applications of their skills.

Career Prospects

CMAs are in high demand in manufacturing sectors, service industries, finance departments, and even government roles. Common job roles include:

➢ Cost Analyst

➢ Financial Consultant

➢ Budget Analyst

➢ Risk Manager

➢ Chief Financial Officer (CFO)

They are also eligible to set up independent practice, providing consulting services in areas such as cost auditing, taxation, and corporate financial planning.

Why Choose CMA?

The CMA qualification is well-suited for those interested in the intricacies of cost control and efficiency. It provides a specialized skill set for addressing the financial and strategic challenges that organizations face in today’s competitive environment.

Subjects and Fee Structure